Starting from Debt to Prosperity: An Influence of Financial Advisers on One's Quest

Navigating the complex world of personal finance can feel daunting, especially when faced with mounting debt or uncertain investments. Many individuals discover themselves at a crossroads, wondering how to move from a state of financial stress to one of stability and wealth. This is where the expertise of financial advisers comes into play. These professionals serve as navigators and mentors, helping clients make educated decisions that can lead to long-term financial success.

In this article, we will explore the varied roles of financial advisers, their importance in achieving your financial goals, and how to select the right ally for your journey. From pension planning to debt management, financial advisers play a crucial role in shaping your financial future. Whether you are an individual looking to increase your wealth or a small business owner needing strategic advice, grasping the benefit of financial advisory services is crucial. Join us as we delve into the many benefits of working with financial advisers and how they can help you turn your financial aspirations into reality.

Picking the Proper Financial Advisor

Choosing the right financial adviser is essential for coordinating your financial goals with practical strategies. Start by assessing your specific needs, whether it's planning for retirement, investment management, or decreasing debt. Assess Informative post to recognize what specialization you need, as various advisers specialize in specific areas. This initial step will help limit your possibilities and verify that the adviser you select has the credentials and experience that best match your financial ambitions.

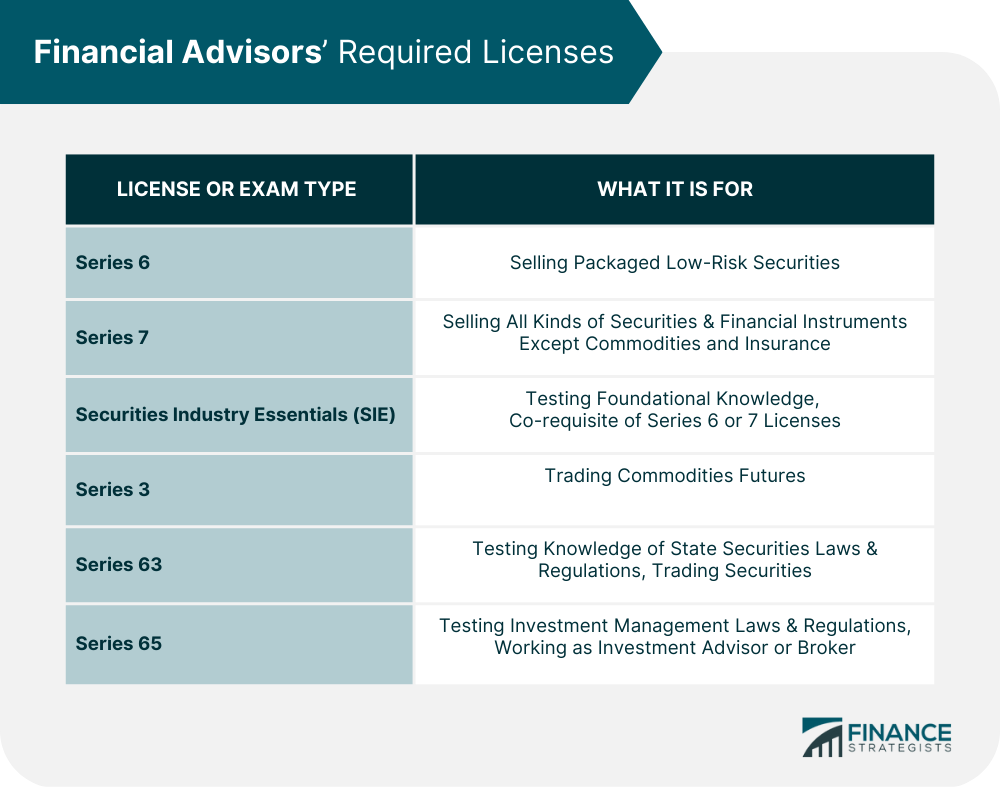

As soon as you have a roster of potential advisers, it is essential to assess their qualifications and credentials. Look for accreditations such as CFP or Chartered Financial Analyst, as these reflect a particular level of expertise and dedication to the profession. Additionally, verify if they are legally obligated to act in your best interest, meaning they are required to act in your interest. Arrange interviews with prospective advisers to gauge their interpersonal skills, views on investing, and overall compatibility with your financial principles.

In conclusion, consider the advisers' compensation models and how they align with your budget. Some advisers charge a flat fee, while others may operate on a commission structure or a percentage of managed assets. Recognizing how they bill for their services can help surprise charges and make sure that their compensation model fits with your financial methodology. The suitable adviser should not only fit your financial capability but also offer open fees and a concise summary of what assistance you can expect in return.

Benefits of Working with Financial Advisers

Working with a financial adviser can offer substantial gains for people looking to enhance their monetary situation. One of the primary advantages is the tailored guidance they offer, custom to your individual economic goals and situations. If you are planning for retirement, allocating funds for a kid's education, or managing liabilities, a financial adviser can create a personalized approach that caters to your requirements and helps you stay on path. This extent of custom guidance can result in more educated decisions and eventually better financial returns.

Another key benefit is the skill that financial advisers offer to the discussion. They possess extensive understanding of economic fields, investment strategies, and tax regulations. This expertise allows them to navigate complex financial environments and offer advice that may not be easily available to the average person. By leveraging their knowledge, you can make certain that your investments are spread out and aligned with your enduring aims, potentially boosting your asset accumulation strategies.

Furthermore, financial advisers can support reduce threats and manage market volatility. They understand the cyclical pattern of markets and can advise strategies to safeguard your assets during declines. This proactive method not only works to maintain your resources but also gives a level of assurance in your financial decisions, knowing that you have someone navigating you through uncertain times. Teaming up with a financial adviser can be a pivotal step toward achieving financial safety and wealth building.

Surveying Financial Consulting in The Current Economic Climate

In today's volatile economic context, maneuvering through fiscal consulting demands a keen comprehension of market trends and the capacity to respond to changing situations. Consumers and businesses alike face unique issues, including inflation, variable interest rates fluctuations, and political risks. A qualified fiscal advisor can provide insightful advice tailored to your particular situation, helping you make wise choices and keep on course towards your monetary objectives.

In addition, as tech continues to advance, the fiscal guidance landscape is shifting more dynamic. The growth of robo-advisers offers a lower-cost solution for simple investment goals, while human financial advisers bring personalized approaches and emotional assistance for more complex fiscal matters. Grasping the variances between these alternatives allows clients to select the suitable type of assistance that aligns with their fiscal aspirations and familiarity with technology.

Ultimately, the appropriate consultant should not only help with short-term monetary problems but also assist clients plan for the future. A emphasis on long-term wealth creation, retirement planning, and managing risks is crucial. Frequent meetings and a proactive approach to financial advising confirm that clients remain responsive and equipped for various changes in the economy, allowing them to succeed no matter the condition of the market.